Institutional capital is executing a sharp rotation. While the broader digital asset market shed $446 million last week, XRP investment products recorded $70.2 million in inflows, according to the latest CoinShares Digital Asset Fund Flows Report.

The divergence is stark. Bitcoin products saw $443 million in outflows—one of the largest weekly pullbacks since October. Ethereum funds followed suit, losing $59.3 million.

XRP (trading at $1.87, +0.43%) and Solana (trading at $125, +1.41%) were the only outliers, with SOL products attracting a modest $7.5 million.

This capital reallocation shows a strategic shift within institutional portfolios, as investors increasingly seek opportunities beyond the established giants like Bitcoin and Ethereum. The robust inflows into XRP products suggest a growing conviction in alternative digital assets that are thought to be emerging from regulatory uncertainty and offering fresh investment avenues.

This strategic diversification reflects a re-evaluation of risk-reward profiles, setting the stage for a closer examination of the specific geographical forces at play in this market-wide recalibration.

The Data: U.S. Sellers, German Buyers

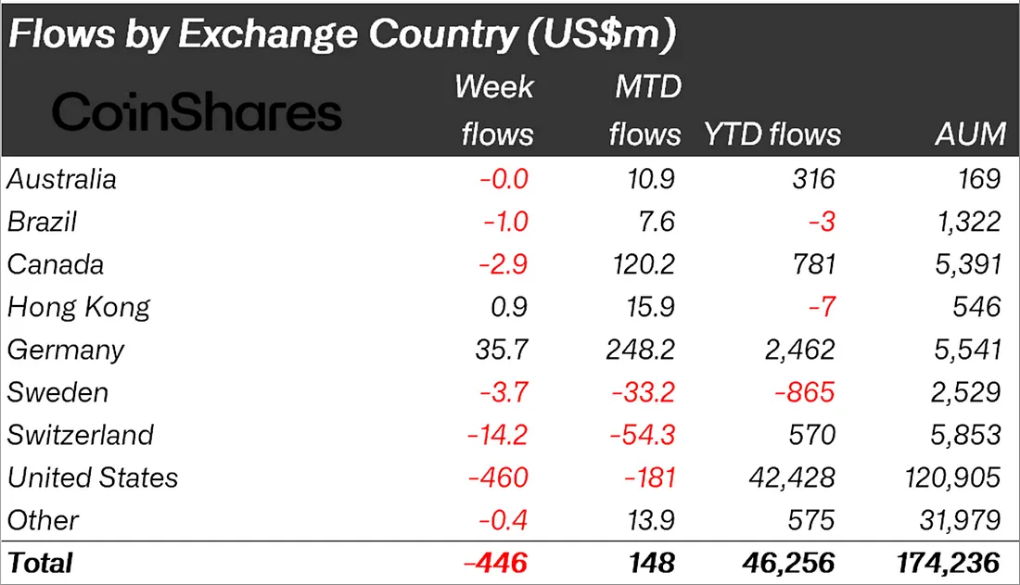

The sell-off was almost entirely U.S.-driven. American funds saw $460 million in withdrawals, likely triggered by lingering macro uncertainty and tariff rhetoric.

Conversely, German investors bought the dip. Germany-based funds posted $35.7 million in inflows, bringing their month-to-date accumulation to $248 million.

“Since the mid-October ETF launches in the US, XRP and Solana have seen $1.07 billion and $1.34 billion of inflows respectively, bucking the negative sentiment seen across other assets,” James Butterfill, head of research at CoinShares, noted.

Specific vehicle data reflects the demand: Franklin Templeton’s recently launched XRP fund alone captured $28.6 million of the weekly volume.

What the Flows Suggest

This isn’t just a “rotation”; it’s a regulatory arbitrage trade. The capital flight from Bitcoin ($2.8B outflows since mid-Oct) coincides directly with the launch of spot XRP and SOL ETFs. Institutions are reallocating risk budgets toward assets with fresh regulatory “wrappers” and lower saturation.

The Germany-U.S. split is equally important because European desks are accumulating while U.S. entities de-risk ahead of Q1 fiscal shifts. Expect this bifurcation to persist until the tariff narrative stabilizes.

The post XRP ETPs Absorb $70M as Institutions Rotate Out of Bitcoin appeared first on Cryptonews.