Pump.fun’s recent cash-outs have reignited a familiar debate in crypto about when profit becomes “extraction” and when it is simply the result of a business model working as designed.

The discussion intensified after on-chain data showed the Solana-based meme coin launchpad transferring funds to centralized exchanges while reporting one of the most profitable quarters of the cycle.

According to Arkham data, Pump.fun deposited about $50,000 to Kraken in the past 24 hours.

More significantly, analysts tracking historical flows estimate that in Q4 2025 alone, the platform moved close to $615 million off-chain.

That figure quickly circulated on X, where it was framed by some commentators as one of the largest profit-taking events of the cycle.

Pump.fun Prints Cash, Critics Cry “Extraction,” As Supporters Call it Mere Profit Taking

Data compiled from DefiLlama shows Pump.fun generated roughly $74.1 million in revenue in Q4 2025, contributing to lifetime revenue of about $935.6 million since launch.

Loshmi, a crypto creator with nearly 40,000 followers, argued that Pump.fun has now generated close to $1 billion in total revenue, saying expectations around an airdrop have largely faded.

In his post, he suggested that platforms operating at this scale could exit the market with hundreds of millions in profit, comparing Pump.fun and other trading terminals to “shovel sellers” during a gold rush.

Jeffreycrypt echoed that view, writing that the cycle had drawn a clear line between those building casinos and those playing inside them, with fee collectors ultimately emerging as the winners.

Others have pushed back against that framing, saying crypto analyst posting under the name TedPillow described the Q4 cash-outs as “the biggest extraction of this cycle.”

However, OpenSea ambassador and YouTube creator Crypto Gorilla questioned why profitability in Web3 is often labeled extraction at all.

He argued that users are not forced to use Pump.fun and that the platform is not responsible for individual trading losses.

Pump.fun’s Revenue Boom Masks a Relentless Token Failure Rate

The debate has been complicated by earlier disputes over treasury movements.

In November, Pump.fun’s pseudonymous co-founder Sapijiju denied claims that the project had sold more than $436 million in USDC, saying transfers flagged by blockchain trackers were routine treasury management rather than liquidations.

He said the funds originated from the PUMP token ICO and were redistributed internally to manage runway and operations.

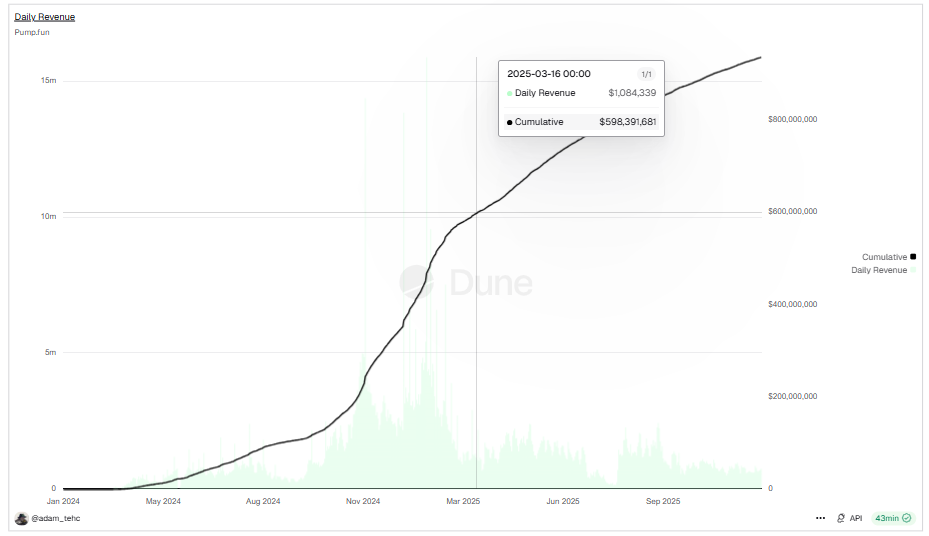

Revenue data provides context for why scrutiny has intensified as Pump.fun’s growth was rapid.

Quarterly revenue climbed from $2.45 million in Q1 2024 to $47.9 million in Q2, then to $207.3 million in Q4 2024.

The platform peaked in Q1 2025 with $256.2 million in quarterly revenue before cooling through the rest of the year.

Even after the slowdown, quarterly revenue remained above $70 million, far higher than its early baseline. With zero reported cost of revenue, nearly all fees flowed directly into profit, giving the protocol close to 100% gross margins.

At the same time, platform usage data highlights the speculative nature of that growth. More than 14.82 million tokens have been created on Pump.fun, but consistently fewer than 1% graduate.

In November 2025, over 514,000 tokens were launched, with just 3,220 reaching graduation.

Similar ratios persisted throughout the year, reinforcing concerns about sustainability even as fee generation remained strong.

Daily revenue and wallet activity charts from Dune Analytics show that while speculative peaks in late 2024 and early 2025 have faded, Pump.fun has retained a sizable base of recurring users and steady fee generation.

That persistence is why the platform continues to rank among the highest-earning crypto applications of the cycle.

The post PumpFun’s $615M Q4 Profit Sparks “Extraction” Debate: Is the Backlash Justified? appeared first on Cryptonews.

https://t.co/BB5leCKHRh’s co-founder

https://t.co/BB5leCKHRh’s co-founder