Key Takeaways:

- Large Bitcoin transactions above $20 million increasingly moved to exchange hot wallets between October and mid-December.

- Around 65% of BTC across whales and institutional-linked flows was sent to exchanges, often seen as a preparatory step rather than immediate selling.

- November marked the peak in outflows across whales, BlackRock-linked wallets, and Wintermute, coinciding with Bitcoin price weakness below $85,000.

- The timing of these peaks suggests a broad liquidity redistribution during the correction, not targeted pressure from a single market participant.

Table of Contents

- In This Article

- In This Article

-

Hot Wallets Are the Main Destination for Large BTC Transfers

-

November Marked the Peak in Large Outflows During Bitcoin Price Weakness

-

Why Are They Doing This?

-

Conclusion

Show Full Guide

window.addEventListener(“DOMContentLoaded”, () => {

const header = document.querySelector(“.header_wrapper”);

const pageLegend = document.querySelector(‘#multiCollapse1’);

const pageLegendList = document.querySelector(‘#multiCollapse2’);

const pageLegendCollapse = new bootstrap.Collapse(pageLegend, {toggle: document.querySelector(“.toc-sticky”).classList.contains(‘sticky’)});

/**

* Changing current title

*/

(function (pageLegend) {

const titleNodes = pageLegend.querySelectorAll(‘.StepProgress-item__link’);

if (!titleNodes.length) return;

const titles = […titleNodes].map((itm, i) => ({

id: itm.getAttribute(‘data-id’),

text: itm.textContent,

level: itm.getAttribute(‘data-level’),

linkNode: itm,

titleNode: document.getElementById(itm.getAttribute(‘data-id’)),

index: i,

}));

/**

* Source: https://www.sitepoint.com/throttle-scroll-events/

* @param {Function} fn

* @param {number} wait

* @returns {(function(): void)|*}

*/

const throttle = (fn, wait) => {

let time = Date.now();

return function () {

if ((time + wait – Date.now()) {

const documentScrollTop = window.pageYOffset || document.documentElement.scrollTop || document.body.scrollTop || 0;

let current = 0;

// Title

titles.forEach((itm, i) => {

//console.log(itm)

const itmOffsetTop = itm.titleNode ? itm.titleNode.offsetTop – 100 : 0;

if (documentScrollTop >= itmOffsetTop) {

document.getElementById(‘toc-current-title’).innerHTML = itm.text;

document.getElementById(‘toc-current-title’).setAttribute(‘data-current-id’, itm.id);

document.getElementById(‘toc-current-title’).setAttribute(‘data-current-level’, itm.level);

current = i;

}

})

// close all list and open sub list if needed

if (document.querySelector(“.toc-sticky”).classList.contains(‘sticky’)) {

document.querySelectorAll(‘.subList-in-progress’).forEach((el) => {

el.children[1].classList.remove(‘show’);

el.getElementsByClassName(‘icon-chevron-down’)[0].classList.remove(‘up’);

});

const currentEl = titles[current];

currentEl.linkNode.classList.add(‘show’);

}

titles.forEach((itm, i) => {

itm.linkNode.parentNode.parentNode.classList.remove(‘current’, ‘is-done’);

if (current > i) {

itm.linkNode.parentNode.parentNode.classList.add(‘is-done’)

};

if (current === i) {

itm.linkNode.parentNode.parentNode.classList.add(‘current’);

};

})

}

changeCurrentTitle();

document.addEventListener(‘scroll’, throttle(changeCurrentTitle, 50));

})(pageLegend);

/**

* Collapse

*/

(function (pageLegend, header) {

const icon = pageLegend.parentNode.querySelector(“.collapse-action-btn i”);

const collapseToggle = (status) => (e) => {

if (!e.target.isEqualNode(pageLegend)) return;

icon.classList.toggle(“up”);

const containerHeight = pageLegend.getBoundingClientRect().height;

const showSubtitleContent = () => {

const currentId = document.getElementById(‘toc-current-title’).getAttribute(‘data-current-id’);

const currentLevel = document.getElementById(‘toc-current-title’).getAttribute(‘data-current-level’);

const currentSubTitle = currentLevel == 3 ? document.querySelector(`a[data-id=”${currentId}”]`).parentNode.parentNode.parentNode : false;

if (!currentSubTitle) return;

new bootstrap.Collapse(currentSubTitle, {toggle: false}).show();

}

showSubtitleContent();

console.log(status + ‘fdsfsd’ + containerHeight);

if (status === ‘shown’ && document.querySelector(“.toc-sticky”).classList.contains(‘sticky’)) {

document.querySelector(‘html’).classList.remove(‘overflow-hidden’);

pageLegend.classList.add(‘overflow-auto’);

pageLegend.style.height = `calc(100vh – ${header.getBoundingClientRect().height + document.querySelector(‘.toc-sticky__open’).getBoundingClientRect().height + 16}px)`;

} else if (status === ‘hide’) {

document.querySelector(‘html’).removeClass(‘overflow-hidden’);

pageLegend.classList.remove(‘overflow-auto’);

pageLegend.style.height=”auto”;

}

}

pageLegend.addEventListener(‘shown.bs.collapse’, collapseToggle(‘shown’));

pageLegend.addEventListener(‘hide.bs.collapse’, collapseToggle(‘hide’));

})(pageLegend, header);

/**

* Collapse sub-titles

*/

(function (pageLegend) {

const collapseEls = pageLegend.querySelectorAll(‘.collapse’);

collapseEls.forEach(function (el) {

const toggleArrowDirection = function (e) {

if (!e.target.isEqualNode(el)) return;

const id = this.getAttribute(‘id’);

document.querySelector(`.collapse-action-btn[data-bs-target=”#${id}”] .icon-chevron-down`).classList.toggle(‘up’);

}

el.addEventListener(‘shown.bs.collapse’, toggleArrowDirection);

el.addEventListener(‘hide.bs.collapse’, toggleArrowDirection);

})

})(pageLegend);

/**

* Collapse main title

*/

(function (pageLegendList) {

const icon = pageLegendList.parentNode.querySelector(“.collapse-action-btn i”);

const collapseToggle = () => (e) => {

if (!e.target.isEqualNode(pageLegendList)) return;

icon.classList.toggle(“up”);

}

pageLegendList.addEventListener(‘shown.bs.collapse’, collapseToggle());

pageLegendList.addEventListener(‘hide.bs.collapse’, collapseToggle());

})(pageLegendList);

(function (pageLegendList) {

const collapseEls = pageLegendList.querySelectorAll(‘.collapse’);

collapseEls.forEach(function (el) {

const toggleArrowDirection = function (e) {

if (!e.target.isEqualNode(el)) return;

const id = this.getAttribute(‘id’);

document.querySelector(`.toc-sticky-list .collapse-action-btn[data-bs-target=”#${id}”] .icon-chevron-down`).classList.toggle(‘up’);

}

el.addEventListener(‘shown.bs.collapse’, toggleArrowDirection);

el.addEventListener(‘hide.bs.collapse’, toggleArrowDirection);

})

})(pageLegendList);

/**

* Sticky functionality

* Source: https://stackoverflow.com/questions/17893771/javascript-sticky-div-after-scroll

*/

(function (header, pageLegendCollapse) {

// set everything outside the onscroll event (less work per scroll)

const target = document.querySelector(“.toc-sticky”);

const targetListStatic = document.querySelector(“.toc-sticky-list”);

if (!target || !header) return;

const headerHeight = header.getBoundingClientRect().height;

const targetHeight = targetListStatic.getBoundingClientRect().height;

// -headerHeight so it won’t be jumpy

const stop = targetListStatic.offsetTop + headerHeight + targetHeight;

const docBody =

document.documentElement || document.body.parentNode || document.body;

const hasOffset = window.pageYOffset !== undefined;

const applySticky = function () {

// cross-browser compatible scrollTop.

const scrollTop = hasOffset ? window.pageYOffset : docBody.scrollTop;

// if user scrolls to headerHeight from the top of the target div

if (scrollTop >= stop) {

pageLegendCollapse.hide();

// stick the div

target.classList.add(“sticky”);

//target.style.marginTop = `${headerHeight}px`;

} else {

pageLegendCollapse.show();

// release the div

target.classList.remove(“sticky”);

target.style.marginTop = “”;

}

}

applySticky();

window.addEventListener(‘scroll’, applySticky);

})(header, pageLegendCollapse);

jQuery(‘span.show_moretoc’).click(function () {

jQuery(‘span.show_moretoc’).hide();

jQuery(‘.ms_hidetoc’).show();

});

});

Bitcoin (BTC) prices continue to trend lower. The market currently looks like a ping-pong match between buyers and sellers. Prices fall, but without a sharp collapse. This is followed by a rebound, but without strong upside momentum. Against this backdrop, speculation is growing that large players may be putting pressure on the market and could be interested in pushing prices lower. But does the data support this idea?

In this research, Cryptonews analyzed large Bitcoin transactions worth more than $20 million per transfer between Oct. 10 and Dec. 15. This timeframe allows us to observe market behavior after the October sell-off. Transactions linked to BlackRock and Wintermute were also reviewed, as both are among the most visible institutional participants.

Hot Wallets Are the Main Destination for Large BTC Transfers

The analysis shows that around 65% of BTC across these groups was transferred to hot wallets, primarily exchanges. This was the most common destination.

Such transfers are usually seen as a preparatory step before selling. However, they do not imply immediate liquidation. Sales may happen later or may not happen at all. Even so, this type of activity often increases caution in the market and influences expectations.

The second most common category was internal transfers. These include Bitcoin moved from one cold wallet to another or to unlabelled addresses. The purpose of these transactions is harder to interpret. In some cases, they may reflect rebalancing, changes in custody structure, or preparation for over-the-counter deals. In current market conditions, these movements can also amplify uncertainty, especially when large BTC volumes regularly move between addresses without a clear explanation.

November Marked the Peak in Large Outflows During Bitcoin Price Weakness

Across all three groups, Bitcoin whales as well as flows linked to BlackRock and Wintermute, activity peaked in November. This occurred after the October 10 sell-off and coincided with Bitcoin trading below $85,000, a period marked by elevated uncertainty.

The trend was most pronounced among Bitcoin whales. In November, their transaction volumes reached the highest levels both in the number of transfers and total BTC moved. Around 11.4 million BTC in outgoing transfers were recorded during the month. At prevailing prices, this represented more than $1 trillion in value. These figures were well above October levels and higher than activity seen in early December, when volumes began to decline.

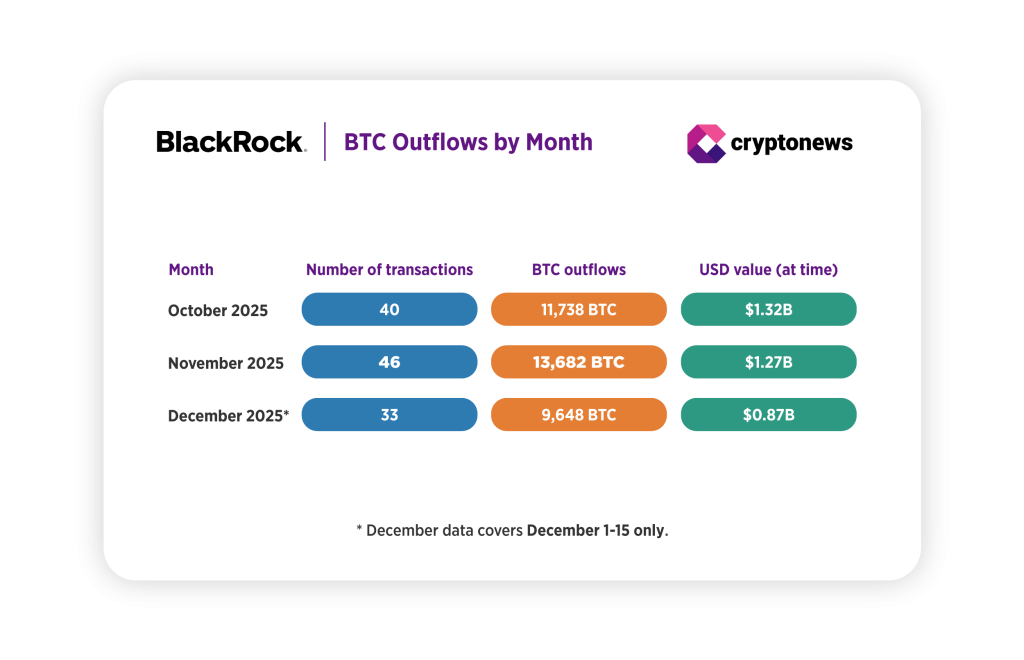

Institutional flows showed a similar pattern. Bitcoin outflows linked to BlackRock also peaked in November. Estimates suggest around $1.3 billion worth of BTC was moved during the month, making it the most active period for this group in the analyzed timeframe.

Wintermute, one of the largest crypto market makers, also recorded its highest monthly volume of outgoing transfers during November. Given Wintermute’s role in providing liquidity, this increase likely reflects intensified trading activity and fund reallocation amid heightened volatility.

The fact that all three groups peaked at roughly the same time points to a broader redistribution of liquidity during a price correction rather than coordinated action by a single market participant.

Why Are They Doing This?

The rising share of BTC transfers to exchange wallets naturally raises questions. While these moves are often interpreted as preparation for selling, they do not automatically mean large players are ready to exit their positions.

During the correction, some market participants have suggested that falling prices could be used to test the resilience of major Bitcoin holders or even to trigger redistribution between them.

When Bitcoin price comes under prolonged pressure, large and highly visible corporate holders like Strategy inevitably draw closer scrutiny. The company is among the largest corporate Bitcoin holders and is closely associated with a strong long-term BTC thesis. This raises a logical question: could price pressure be a way to test how resilient such positions really are, and what would happen if one of the largest public holders changed its stance?

According to experts, drawing direct conclusions is premature. David Dobrovitsky, CEO of Wowduck, says Cryptonews that it would be an oversimplification to single out one company as a key driver of Bitcoin price movements:

It’s hard to single out a private entity as a reason why BTC is going up or down. BlackRock, for example, holds more Bitcoin than Strategy, not to mention various governments. Strategy is a very visible holder, but overall BTC ownership remains sufficiently distributed, meaning one private company should not be able to move the market on its own.

Even so, the idea of a “stress test” for corporate holders is increasingly discussed in the context of current market dynamics.

Dobrovitsky argues the market is not there yet:

Not yet. There is still enough distribution in Bitcoin holdings for price moves to be fully indicative of pressure on a specific corporate holder. What we are seeing instead is a broader downturn across tech markets. Jobs are scarcer, venture capital funding has declined, and there are fewer sectors delivering outsized returns, both for retail and institutional investors.

From this perspective, Bitcoin price decline appears more like part of a wider cooling in risk assets than targeted pressure on specific players.

That said, Michael Saylor’s role remains an important part of the market narrative, even if it is not decisive. “Positive sentiment around Saylor and Strategy certainly helps Bitcoin,” Dobrovitsky adds. “But it shouldn’t be viewed as the be-all and end-all when it comes to BTC price dynamics.”

Conclusion

Depending on interpretation, this activity can be explained in different ways. On one hand, the rise in BTC transfers to exchanges and the increase in internal movements may reflect a broader market cooldown and standard risk reallocation during a price correction and weaker macro conditions. On the other hand, some participants believe falling prices may act as a stress test for the largest Bitcoin holders, including corporate players like Strategy, whose commitment to BTC has become part of the market narrative.

At the same time, on-chain data does not point to targeted pressure on any single participant. Both explanations remain within the realm of market expectations rather than confirmed scenarios.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Is Bitcoin Price at Risk of a Deeper Reset? Whales Signal Caution | Research appeared first on Cryptonews.