Binance’s launchpad ecosystem has delivered some of the strongest headline returns in the market over the past year.

However, recent data shows a widening gap between early exits and long-term holders, raising questions about how value is actually distributed across token launches.

As Public Token Sales Return, Binance Wallet Emerges as the Clear Leader

Data compiled by DeFi Oasis and CryptoRank shows Binance Wallet leading all major ICO, IDO, and IEO platforms by a wide margin.

Over the past year, Binance Wallet recorded a current return on investment of 12.69x, with an all-time high ROI reaching 78.01x across 44 launched projects.

Its most recent launch took place on Dec. 17. No other platform came close to matching that peak performance, reinforcing Binance’s position as the dominant venue for primary token distribution.

MetaDAO ranked second in current performance, posting a 4.15x ROI and an all-time high of 8.73x from seven projects, with its latest launch in mid-November.

The platform has drawn attention alongside rising interest in Solana-based issuance models, particularly as traditional Solana ecosystem listing channels have become more constrained.

OKX Wallet followed with a current ROI of 3.22x and an ATH ROI of 34.75x, despite launching only three projects this year, highlighting how limited supply can distort peak performance metrics.

Echo, founded by crypto investor Cobie and recently acquired by Coinbase in a $375 million deal, placed fourth with a current ROI of 2.83x and an ATH ROI of 17.08x across 30 projects.

Coinbase said the acquisition is intended to simplify community-based fundraising and bring more transparency to public token sales, a model that has seen renewed interest after years of decline following the 2017 ICO boom.

The deal comes as public token launches quietly return through platforms that emphasize compliance and investor protections.

Beyond the top tier, returns dropped sharply. MEXC recorded a current ROI of 1.98x, and Kraken Launch posted 1.92x, while Buildpad delivered 1.22x despite an ATH ROI near 10x across six projects.

Platforms such as LEGION, Cake Pad, and Bybit all reported current ROIs below 1x, meaning many tokens are now trading below their initial launch prices.

In total, eight of the twelve major launchpads tracked posted average current ROIs below 2x, with five already below 1x.

Launchpads Thrived on Activity, Not Holding Power

Analysts tracking these figures say the divergence reflects timing rather than platform quality.

According to DeFi Oasis, participants who exited positions shortly after launch generally realized profits, while those who continued holding tokens saw gains evaporate as liquidity thinned and post-launch selling pressure set in.

The data suggests that control over liquidity, rather than long-term token fundamentals, has been the defining factor in launchpad performance.

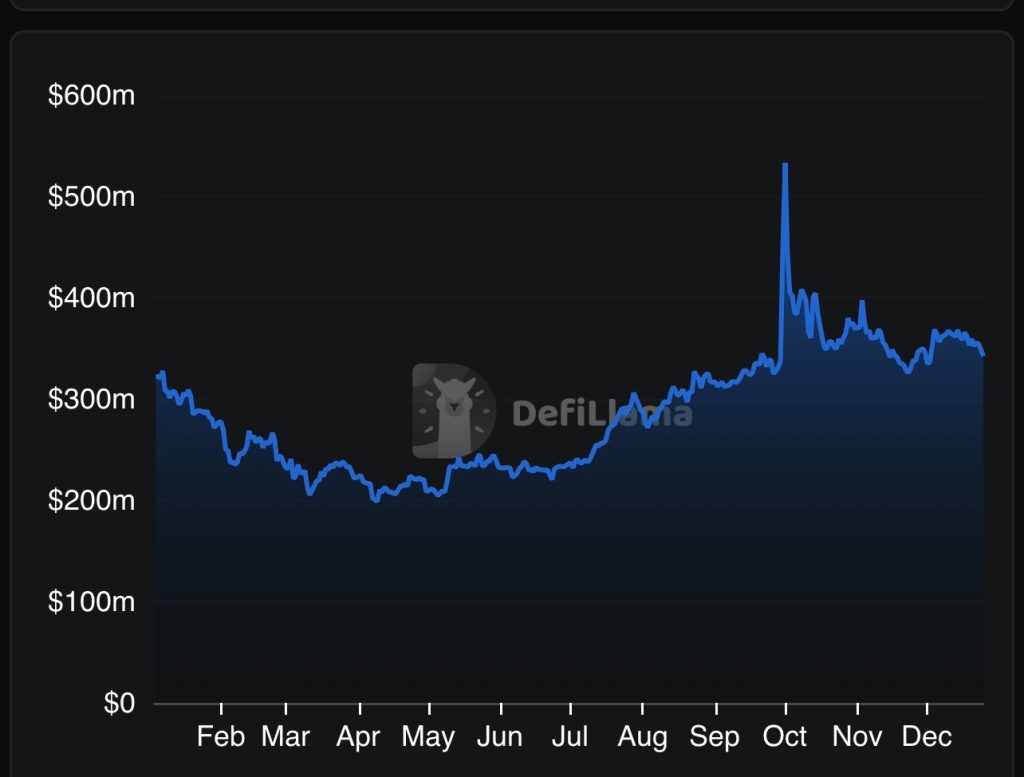

Broader market data helps explain the pattern as DeFi total value locked declined steadily from February through April, falling roughly 32% as capital exited risk assets.

Much of that capital later exited, but the market settled at a higher base by year-end, signaling partial retention rather than a full reversal.

On Oct. 1, launchpad-related activity spiked, with volume reaching more than $530 million. By December, total value locked stood at about $342 million, while seven-day fees reached $7.51 million and revenue totaled $6.77 million.

Activity across meme-focused and experimental platforms such as pump.fun, four.meme, and Binance Alpha reflected strong short-term participation rather than sustained holding behavior.

The current landscape shows a launchpad market that remains active and profitable for disciplined participants while exposing longer-term holders to declining returns once early momentum fades.

As compliant launchpads such as Sonar, Buildpad, Legion, and Kaito gain traction, the structure of token launches continues to evolve, but the underlying data shows that timing, liquidity, and exit discipline remain central to outcomes.

The post Binance Hits 78x Launchpad ROI, Yet HODLers Are Getting Wrecked — Here’s Why appeared first on Cryptonews.