The Bank of Russia has set out a timeline that would bring Russia’s fragmented cryptocurrency rules under a single, enforceable framework by mid-2026, while preparing new penalties for illegal market activity from 2027.

The proposal, published on December 23, marks one of the clearest indicators yet that the central bank is moving from years of resistance toward tightly managed regulation, rather than outright prohibition.

Russia Outlines Split Rules for Retail and Qualified Buyers

Under the concept submitted to the government, both qualified and non-qualified investors would be allowed to buy cryptocurrencies, though under sharply different conditions.

Non-qualified investors would be limited to purchasing a defined list of the most liquid cryptocurrencies after passing a mandatory knowledge test.

Their annual purchases would be capped at 300,000 rubles, or about $3,800, through a single intermediary.

Qualified investors, meanwhile, would be allowed to buy any cryptocurrency except so-called anonymous tokens that conceal transaction data.

They would not face volume limits but would still be required to pass testing to demonstrate an understanding of the risks involved.

The Bank of Russia reiterated that while cryptocurrencies and stablecoins would be recognized as monetary assets that can be bought and sold, they would remain barred from domestic payments.

This position aligns with existing law passed in 2020, which restricts crypto use to investment purposes and requires all payments inside Russia to be conducted in rubles.

That stance was reinforced again on December 17, when State Duma financial markets committee chairman Anatoly Aksakov said cryptocurrencies would “never become money” in Russia and could only function as investment instruments.

Russia Lays Out Phased Plan to Legalize Crypto Market Activity

If adopted, the new rules would allow crypto transactions to take place through existing licensed infrastructure.

Exchanges, brokers, and trustees could operate under their current licenses, while separate requirements would be introduced for specialized crypto depositories and exchangers.

Russian residents would also be allowed to buy cryptocurrencies on foreign platforms using overseas accounts and to transfer previously acquired assets abroad through Russian intermediaries, provided such transactions are reported to the tax service.

The concept also extends to Russia’s digital financial asset market, which would allow DFAs and other digital rights to circulate on open networks.

This would allow issuers to attract foreign investment and give buyers access to products on terms comparable to cryptocurrency investments.

The central bank has called for the legislative framework underpinning the proposal to be completed by July 1, 2026.

From July 1, 2027, liability would be introduced for illegal activities by crypto intermediaries, modeled on penalties for illegal banking operations.

This timeline suggests a gradual transition from the current gray zone toward formal enforcement.

Crypto Didn’t Disappear in Russia—It Got Too Big to Ignore

The shift reflects a longer evolution in Russia’s crypto policy. Before 2022, the Bank of Russia repeatedly pushed for a full ban on crypto trading and mining, arguing that private digital currencies threatened financial stability.

That position softened after sweeping Western sanctions cut Russia off from parts of the global financial system.

Since then, lawmakers have legalized crypto mining, approved experimental use of crypto for cross-border settlements, and begun building a regulated domestic market alongside the Finance Ministry.

Recent data underline why regulators are now focusing on structure rather than suppression.

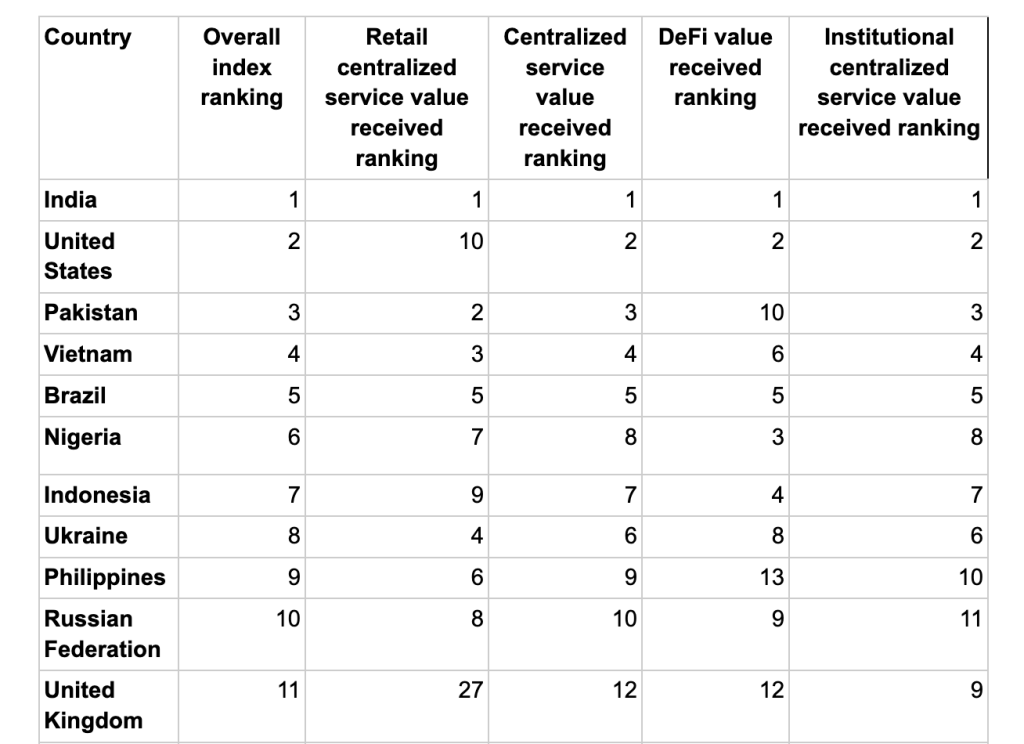

Chainalysis has ranked Russia among the world’s top 10 countries for crypto adoption, with the country receiving more than $376 billion in crypto transactions between July 2024 and June 2025

Officials have framed the new approach as a way to bring existing participation under oversight rather than expand crypto’s role in the economy.

The post Bank of Russia Targets 2026 for Strict Crypto Regulation Framework and New Penalties appeared first on Cryptonews.

Russian lawmaker Anatoly Aksakov said that payments in Russia must only be conducted in rubles, dismissing crypto becoming legal tender.

Russian lawmaker Anatoly Aksakov said that payments in Russia must only be conducted in rubles, dismissing crypto becoming legal tender.