Metaplanet shareholders approved all five proposals at an extraordinary meeting on Friday, clearing the way for two new classes of preferred shares designed to fund Bitcoin purchases while delivering fixed monthly and quarterly dividends to investors.

The Tokyo-listed company, which holds 30,823 BTC worth roughly $2.7 billion, is now positioned to raise capital through dividend-paying securities rather than further diluting common stockholders.

Executive Dylan LeClair confirmed the meeting’s outcome on social media, as CEO Simon Gerovich also thanked attendees after all agenda items passed.

The approvals included expanding authorized preferred shares to 555 million for both Class A and Class B structures, amending Class A shares to carry monthly floating-rate dividends under the MARS (Metaplanet Adjustable Rate Security) system, and authorizing the issuance of Class B preferred shares to overseas institutional investors.

Metaplanet Mirrors Strategy’s Dividend-Backed Bitcoin Funding Model

The MARS structure mimics Strategy’s STRC preferred stock, which launched in July and currently trades near $98 with an annualized dividend of about 10.75%.

STRC’s dividend adjusts monthly to keep the stock near its $100 target price, reducing volatility while offering steady income to investors seeking Bitcoin exposure without direct equity risk.

Strategy has used STRC proceeds to fund Bitcoin purchases, with about 21,000 BTC acquired from the program’s initial public offering alone.

Metaplanet’s Class A preferred shares will pay adjustable monthly dividends designed to deliver price stability, with rates rising when the stock trades below par and falling when it trades above.

Class B shares, branded “Mercury,” pay a quarterly dividend of 4.9% annually and offer the option to convert to common stock if Metaplanet’s share price triples from current levels.

The Mercury shares raised ¥21.25 billion ($135 million) in November through a third-party allocation to overseas institutional investors, with a conversion price set well above the prevailing market rate to limit near-term dilution.

Back then, Gerovich stated the structure aims to “minimize dilution from common share issuances while continuing to expand BTC holdings,” calling it a “new step in scaling” the company’s Bitcoin treasury strategy.

The company also approved shifting capital stock and capital reserves to capital surplus, increasing capacity for preferred share dividends and potential share buybacks.

The Class B shares are subject to a 10-year 130% issuer call and include an investor put right, unless an initial public offering occurs within one year.

U.S. Trading Access Opens Through Sponsored ADR Program

The shareholder approvals followed Metaplanet’s launch of a Sponsored Level I American Depositary Receipt program, giving U.S. investors dollar-denominated access to the company’s equity under the ticker MPJPY.

Deutsche Bank Trust Company Americas serves as the depositary, while MUFG Bank acts as the custodian for the underlying shares in Japan.

Each ADR represents one ordinary Metaplanet share and trades on the U.S. over-the-counter market.

Gerovich said the ADR program “directly reflects feedback from U.S. retail and institutional investors seeking easier access to our equity.”

The structure improves settlement efficiency, lowers transaction costs, and increases transparency for U.S. investors who face operational and regulatory hurdles when trading foreign-listed stocks directly.

Metaplanet’s shares previously traded in the U.S. under the symbol MTPLF, but that arrangement involved no formal agreement with a depositary bank and limited the company’s ability to provide consistent disclosures and investor support.

The ADR launch is not designed to raise capital and does not affect the number of issued common or preferred shares.

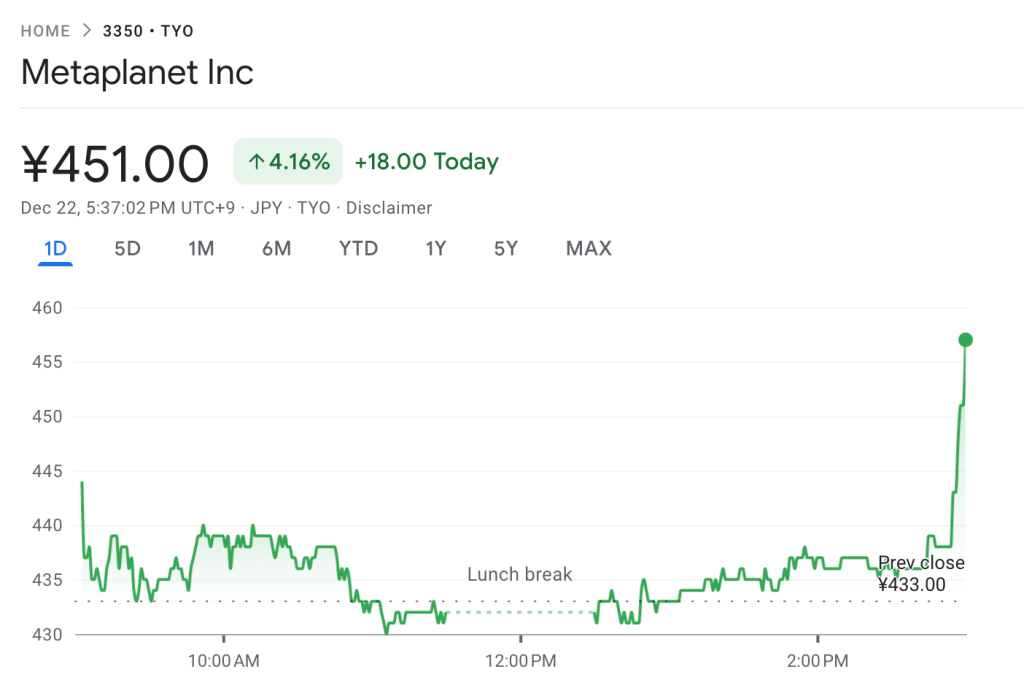

Notably, Metaplanet shares rose 4% today following the announcement, closing at 451 yen.

Metaplanet accumulated roughly 29,000 BTC in 2025 but paused purchases in late September amid volatility that pressured Bitcoin treasury companies.

The company also secured a $130 million loan in November backed entirely by Bitcoin under a $500 million credit facility, maintaining what it described as a sufficient collateral buffer even during periods of strong price volatility.

The post Japan’s Biggest Bitcoin Holder Now Offering Dividend Shares to Investors appeared first on Cryptonews.

Metaplanet raises $135M for Bitcoin acquisitions as Saylor defends treasury strategy, saying Strategy can withstand 80-90% drawdowns.

Metaplanet raises $135M for Bitcoin acquisitions as Saylor defends treasury strategy, saying Strategy can withstand 80-90% drawdowns.