Analysts at Samosa Capital Investment Fund have warned that Michael Saylor’s BTC strategy is “hurting Bitcoin’s price action”, which is a net-negative for the Bitcoin community.

According to certified analysts, Saylor’s Bitcoin digital asset treasury company, Strategy (formerly MicroStrategy), is “a highly leveraged holding company traded on public exchanges that could blow up, exactly the opposite of what Bitcoin was intended to be.”

Vinny Lingham, economist and co-founder at Praxos Capital, also complained about how Saylor’s Strategy could ultimately do more harm to Bitcoin (and crypto) than what FTX did.

Saylor’s Strategy Is the Opposite of What Bitcoin Was Meant to Be

These concerns come just days after Saylor announced that the Bitcoin Strategy company had purchased 8,178 BTC at an average price of $102,171, approximately 10% above current market levels.

According to data from CryptoQuant, this recent Bitcoin move puts ~40% of Strategy’s 649,870 BTC holdings in the red zone.

Bitcoin critic Peter Schiff called Strategy’s entire business model a “fraud.”

He revealed that both he and Saylor will speak at Binance Blockchain Week in Dubai in early December and challenged Saylor to a debate, concluding: “Regardless of what happens to Bitcoin, I believe $MSTR will eventually go bankrupt.”

These concerns come as Bitcoin has lost over 25% since early October, and market participants have questioned why Saylor, who regularly posted trackers and bought when the market rallied, is suddenly quiet during red days.

“Buy High, Do Nothing,” Critics Slam Saylor’s Quiet Red Market Strategy

Popular crypto KOL Ansem spotted this pattern in April when Bitcoin dipped 30% to $74k, reacting: “the funniest part about all of this is when we truly needed a turbo bid to jumpstart the digital gold safe haven narrative, this nigga Saylor has bought stone cold zero Bitcoin.”

Helius Labs CEO Mert Mumtaz shared the sentiment, noting that DATs buy in size when prices peak but go silent during discounts.

“So their strategy is literally buy high and then do nothing? Just a creative way of driving crypto money to CNBC, it seems.”

Bitcoin Maxis now believe BTC’s original cypherpunk vision has been hijacked.

According to a Delphi Digital analyst, Strategy and DATs are “hurting Bitcoin’s price action”, not just because Bitcoin has underperformed assets like the Nasdaq-100 Index, but “because its role as a sovereign, censorship-resistant, private medium of wealth storage and transfer has been hollowed out.”

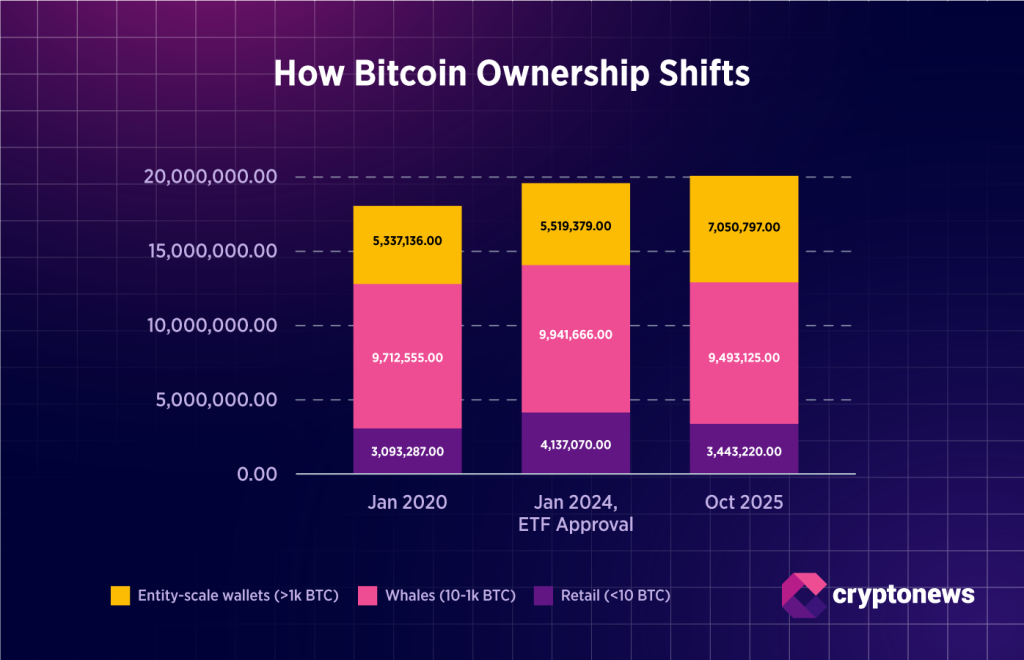

For example, ~9% of all BTC sits in US ETFs or government treasuries today, which are custodial, surveilled, fully transparent structures where personal sovereignty is basically zero.

Analysts argue that this dilution into central authority, which Bitcoin was meant to resist as censorship-resistant money, is drifting away from its original purpose since the emergence of DATs like Saylor’s Strategy.

Saylor Claims MSTR Can Survive 80-90% Bitcoin Crash.

However, when GrokAI was asked what price Bitcoin would have to fall to for MSTR to be in trouble and have to sell Bitcoins.

It responded that Bitcoin would need to drop to around $12,650 for MicroStrategy ( MSTR) to face serious financial trouble, where the value of its Bitcoin holdings roughly equals its total debt of about $8.22 billion.

At that level, the company’s balance sheet would be underwater without other assets or refinancing options, potentially forcing a sale of Bitcoin to address liabilities.

However, the debt is through convertible notes that lack strict covenants tying assets to Bitcoin’s price, so immediate liquidation isn’t guaranteed.

CEO Michael Saylor also stated that the firm could withstand an 80-90% Bitcoin drop (to ~$18,800-$9,400) and remain overcollateralized.

In other words, despite analysts’ warnings of MSTR’s implosion, the underlying fundamentals still stand strong.

The post Analysts Warn Saylor’s BTC Strategy is “Hurting Bitcoin Price Action” as His Portfolio Turns Red appeared first on Cryptonews.