Bitcoin tumbled below $90,000 on Tuesday, marking the first time it breached this psychological threshold since April and pushing the average spot ETF investor into collective losses for the first time since these products launched.

The decline has erased all gains made in 2025 and now sits more than 30% below its record high of over $126,000 reached in early October, with billions of dollars in unrealized losses weighing on both retail and institutional portfolios.

According to Bloomberg, the flow-weighted average cost basis across all ETF inflows now stands at approximately $89,600, a level Bitcoin broke through during Tuesday’s Asian trading session.

While early investors who purchased between $40,000 and $70,000 remain profitable, market sentiment has deteriorated despite the influx of institutional capital.

Perfect Storm of Selling Pressure Drives Historic Drawdown

The sell-off has pushed Bitcoin ETFs to their second-largest drawdown since launch, with products collectively down $3.29 billion from their peak.

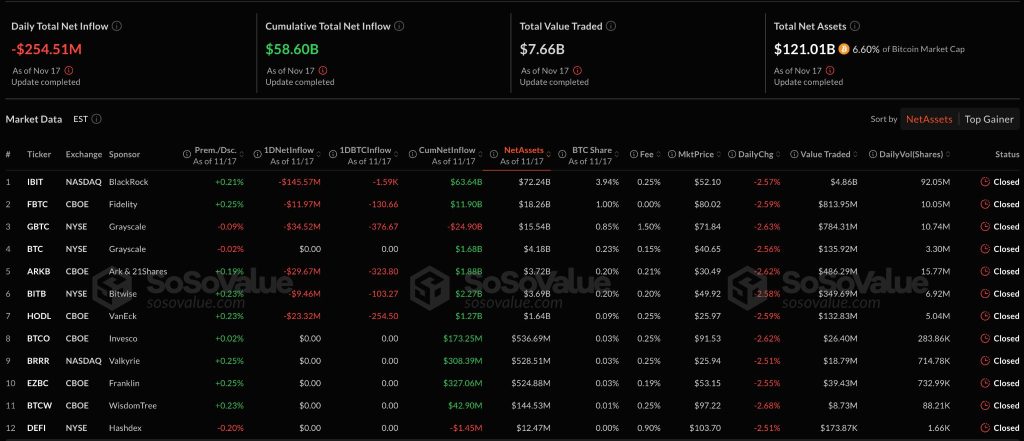

On November 17 alone, ETF outflows reached $254.51 million, led by BlackRock’s IBIT shedding $145.57 million and significant redemptions across Grayscale’s GBTC and Ark’s ARKB.

Bitcoin dominance simultaneously fell below 60% for the first time in over a month, while Ether dropped below $3,000 and major tokens, including XRP, BNB, and Solana, declined between 3% and 5.6%.

Market analysts attribute the downturn to a confluence of factors that have created unprecedented selling pressure.

Long-term holders who accumulated Bitcoin over the past decade are taking profits after reaching their psychological $100,000 target, while traders subscribing to the four-year cycle theory are attempting to time exits.

Speaking with Cryptonews, Farzam Ehsani, Co-founder and CEO of VALR, noted that traditional market fears are driving the decline.

“The main reason for the crypto market decline is growing investor fears in traditional markets,” Ehsani explained.

“Technology stocks, particularly those associated with artificial intelligence, have come under pressure, as investors have begun taking profits, believing current multiples are excessively high.”

Mounting concerns that the Fed may forgo interest rate cuts in December, with probability now below 50%, have further dampened risk appetite across digital assets.

Strong Hands Accumulate Amid Market Panic

Despite pervasive bearishness, on-chain data reveals an unusual pattern that historically precedes significant market moves.

CryptoQuant analysis reveals that demand from long-term, price-insensitive holders has surged from 159,000 BTC to 345,000 BTC since October 6, marking the largest accumulation seen in recent cycles.

Typically, such aggressive absorption by permanent holders triggers supply squeezes and short-term rallies; yet, this time, the price has moved sharply lower.

Ki Young Ju from CryptoQuant characterized the movement as long-term holders rotating among themselves.

“This dip is just long-term holders rotating among themselves,” Ju stated. “Old Bitcoiners are selling to tradfi players, who will also hold for the long run.”

He noted that the market structure has fundamentally changed with ETFs, MicroStrategy, and other channels continuously injecting fresh liquidity, while sovereign funds, pension funds, and corporate treasuries are now building even larger liquidity channels.

Plan C, a prominent market analyst, maintains that nothing has fundamentally changed for Bitcoin’s long-term trajectory.

“I still see 2026 being a bull market for Bitcoin,” Plan C wrote.

“I think this is a relatively short-lived, 1-to-3-month temporary correction similar to what we saw during the drop to $75,000 near the beginning of the year.”

He emphasized that with Bitcoin’s market cap comfortably above $1 trillion, the asset no longer carries the “it could go to zero” discount from previous bear markets.

Critical Technical Levels Determine Near-Term Path

Ehsani outlined critical technical thresholds that will determine Bitcoin’s trajectory.

“To confirm the end of the rally, the market must fall below the $92,000 zone, which will be the final signal of a break in the structure,” he stated.

“A breakout above $105,000 is necessary to return to a confident growth pattern.”

Currently, optimistic scenarios remain plausible if macroeconomic conditions stabilize.

“If ETF demand remains strong and the macro backdrop improves, Bitcoin may return to the $111,000–$116,000 range by year-end and could target $130,000–$140,000 in Q1 2026,” Ehsani projected.

Cameron Winklevoss, Gemini co-founder, struck an optimistic note amid the turbulence, declaring “this is the last time you’ll ever be able to buy Bitcoin below $90K.“

The post Bitcoin Slides Below $90K as ETF Investors Face First Major Losses – More Dips Ahead? appeared first on Cryptonews.