Bitcoin’s recent decline reflects a sharp deterioration in U.S. dollar liquidity rather than any shift in political rhetoric, according to Arthur Hayes, co-founder and former CEO of BitMEX.

In a new column, Hayes draws parallels between unpredictable winter storms in Hokkaido and the equally volatile liquidity conditions shaping digital-asset markets.

Hayes opens with an analogy from his annual ski routine in Japan, noting that early-season decisions must often be made with incomplete information—a dynamic he believes mirrors the way traders interpret macroeconomic signs.

“Bitcoin is the free-market weathervane of global fiat liquidity,” he writes, arguing that the asset trades primarily on expectations of future money supply.

From “Up Only” to a 25% Pullback

Following the U.S. “Liberation Day” market turbulence on April 2, Hayes says he adopted an optimistic stance, predicting a sustained rally fueled by fiscal stimulus and accommodative policy indicators from the Trump administration. Bitcoin initially climbed 21% after tariff pressures eased, and a decline in Bitcoin dominance suggested renewed appetite for altcoins such as Ether.

However, the positive momentum stalled. Since early October, Bitcoin has fallen roughly 25% from its all-time high, a move Hayes attributes not to changing political messages but to a contraction in dollar liquidity.

He cites his proprietary USD Liquidity Index, which he says has declined 10% since April, even as Bitcoin rallied 12% during that same period.

ETF Basis Trades Masked Liquidity Stress

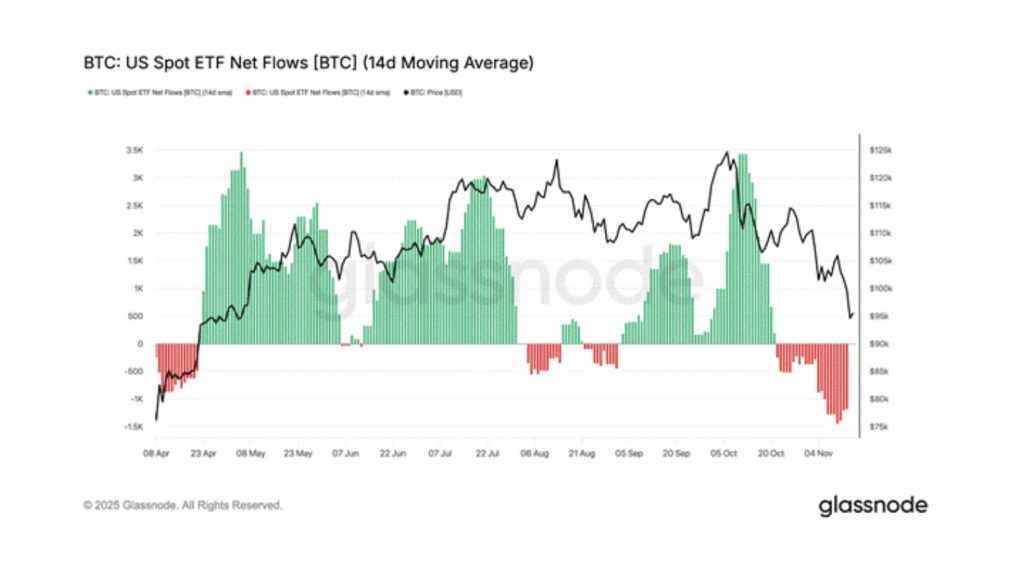

According to Hayes, that divergence was temporarily supported by inflows into spot Bitcoin ETFs and accumulation by Digital Asset Treasury (DAT) companies such as Strategy. However, these flows masked underlying macroeconomic weaknesses.

Hayes notes that many of the largest ETF inflows came not from long-term institutional adoption but from hedge funds executing basis trades—buying spot Bitcoin ETFs while shorting CME Bitcoin futures to capture the spread. As the spread narrowed, those investors reduced their positions, leading to large ETF outflows.

DATs also slowed their purchasing activity, he adds, as premiums on their publicly traded shares fell into discounts relative to net asset value. “Without these flows obscuring the negative liquidity picture, Bitcoin must fall to reflect the current short-term worry that dollar liquidity will contract,” Hayes writes.

A Political Test for Liquidity Creation

Looking ahead, Hayes argues that the future trajectory of markets will hinge on whether the administration can inject new liquidity into the system. He expects political pressure—particularly ahead of the 2026 midterm elections—to ultimately force policymakers to reignite stimulus despite public rhetoric about fighting inflation.

While he sees “short-term lulls” in fiat creation as inevitable, Hayes maintains a longer-term bullish outlook, predicting that sustained money printing will eventually return. In the meantime, he warns that Bitcoin may need to retrace further to align with tightening liquidity conditions.

The post Arthur Hayes Blames Bitcoin’s 25% Slide on a Sudden Liquidity Contraction appeared first on Cryptonews.