Digital asset investment products attracted a record $5.95 billion in inflows last week, the largest weekly total on record, driven by delayed responses to weak U.S. employment data and concerns over government stability following the shutdown that began on October 1, according to CoinShares.

Bitcoin led with an unprecedented $3.55 billion in weekly inflows, while Ethereum recorded $1.48 billion and Solana broke its weekly record with $706.5 million.

The surge pushed total assets under management to an all-time high of $254 billion.

The United States dominated regional flows with a record $5.0 billion in weekly inflows, while Switzerland broke its own record at $563 million and Germany posted its second-largest weekly inflows totaling $312 million.

XRP also saw substantial inflows of $219.4 million, though other altcoins attracted minimal capital.

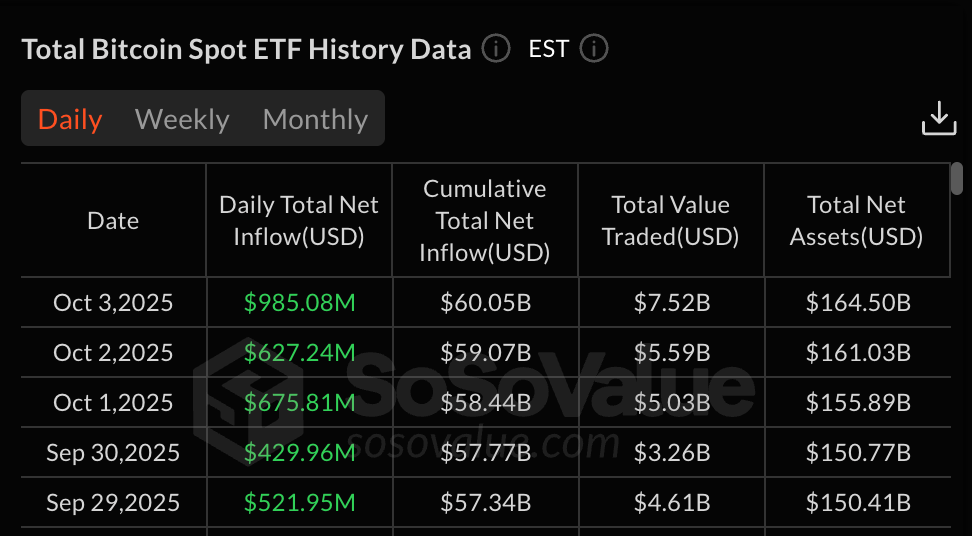

Bitcoin spot ETFs alone recorded $3.24 billion in net weekly inflows from September 29 to October 3, marking the second-highest weekly total in history, while all nine Ethereum spot ETFs posted positive inflows for a combined $1.3 billion.

The flood of institutional capital came as Bitcoin set a new ATH above $125K, following a surprise ADP payroll data showing a loss of 32,000 private jobs in September versus expectations for a 45,000 gain.

The disappointing figures marked the third decline in four months, pushing the probability of a 25-basis-point Federal Reserve rate cut at the next FOMC meeting to 99%, according to the CME FedWatch Tool.

Job openings rose by just 19,000 in August to 7.208 million, near their lowest since January 2021, while the job vacancy-to-unemployment ratio dropped to 0.98, its weakest reading since April 2021.

Government Shutdown and Dollar Weakness Accelerate Debasement Trade

The U.S. government shutdown, which began at midnight on October 1 after Congress failed to pass a funding bill, has furloughed approximately 800,000 federal workers, nearly 40% of the federal workforce, while another 700,000 workers are working without pay.

The stalemate threatens widespread disruption, from air travel to public parks, and has delayed key economic data releases, including employment numbers and inflation reports.

Polymarket bettors predict the shutdown will continue until October 15 or later, with 73% selecting that date as the earliest possible resolution.

The political dysfunction has accelerated the “debasement trade” as the dollar tracks toward its worst year since 1973, down over 10% year-to-date and having lost 40% of purchasing power since 2000.

According to a report that Cryptonews covered earlier today, Bloomberg analysts described investors fleeing major currencies for perceived safety in Bitcoin, gold, and silver as Washington gridlock compounds fiscal concerns.

The correlation coefficient between gold and the S&P 500 reached a record 0.91 in 2024, meaning the traditional safe-haven asset and risk assets moved in tandem 91% of the time, according to The Kobeissi Letter.

Gold has climbed nearly 47% year-to-date to hit $3,924.39 per troy ounce on October 7, boosted by over 1,000 tons of central bank purchases led by China and India.

Silver has gained over 60% year-to-date while Bitcoin surged past $125,000 for the first time on October 5, elevating its market capitalization above $2.5 trillion.

Spot Demand and Whale Accumulation Support $130K Breakout Targets

Taker buy volume on Binance has dominated sell volume throughout October, outpacing sellers by approximately $1.8 billion in futures volume according to CryptoQuant.

Funding rates on Binance remain neutral or slightly negative despite rising prices, suggesting quiet accumulation rather than speculative excess.

The Coinbase Premium Gap reached $92, indicating strong demand from U.S. institutional buyers willing to pay premiums to acquire Bitcoin positions.

During the same period, Bitcoin open interest reached a record $45.3 billion, marking the highest level of leverage ever recorded.

On-chain data from CryptoQuant shows Bitcoin entering Q4 with conditions supportive of a rally after reclaiming the Trader’s Realized Price at $116,000.

Spot Bitcoin demand has grown steadily since July at a rate of 62,000 BTC per month, while large address holdings are expanding at an annual rate of 331,000 BTC, compared to 255,000 BTC in Q4 2024.

Centralized exchanges report the lowest levels of Bitcoin reserves in six years, which is tightening the supply as institutional demand accelerates.

CryptoQuant estimates these catalysts could expand Bitcoin’s potential Q4 target range toward $160,000-$200,000, with the STH-MVRV pricing corridor’s upper boundary sitting near $130,000, where profit-taking historically intensifies.

The post $6 Billion Floods Crypto in One Week – Institutions Going All-In on Bitcoin, ETH, SOL appeared first on Cryptonews.