More than 10,000 South Korean crypto investors now hold digital assets exceeding 1 billion won ($750,000) across domestic exchanges, with young investors in their 20s maintaining the highest average holdings despite representing the smallest demographic group.

According to the Korean Times, the data showed that one in five Koreans actively trades cryptocurrencies.

Young Investors Lead Holdings With Smallest Numbers

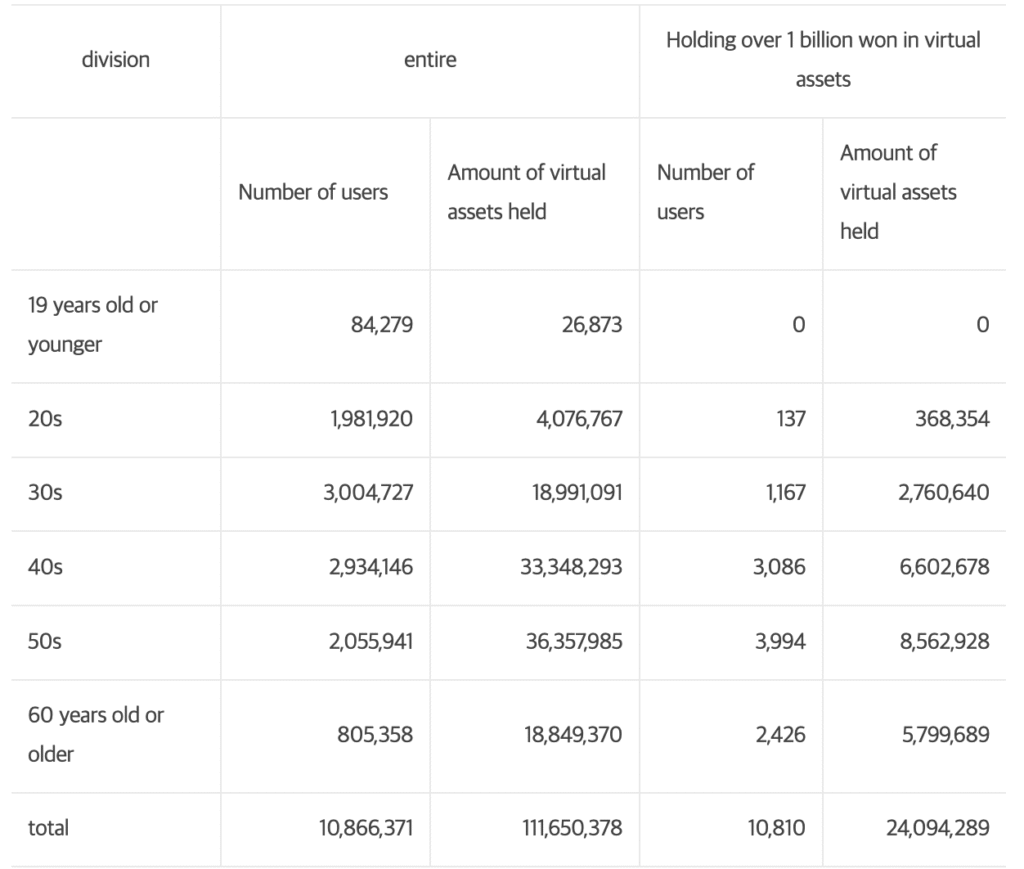

Financial Supervisory Service data submitted to lawmakers reveals 10,810 users across Korea’s five major exchanges, including Upbit, Bithumb, Coinone, Korbit, and GOPAX, each held assets surpassing the 1 billion won threshold as of August 5.

These crypto millionaires maintain average balances of 2.23 billion won, approximately 217 times the overall user average of 10.27 million won.

The demographic breakdown reveals that investors in their 50s dominate by numbers, with 3,994 individuals, followed by those in their 40s with 3,086 participants.

However, despite comprising only 137 individuals, investors in their 20s lead by average holdings at 2.69 billion won per person, surpassing all other age groups significantly.

Korea’s total crypto trading population has reached 10.86 million active accounts capable of trading, representing roughly 20% of the nation’s 51.7 million population.

Collectively, these users hold digital assets worth 111.6 trillion won, with Upbit commanding 76% of millionaire investors despite holding 52% market share across the top five exchanges.

Government Fast-Tracks Pro-Business Crypto Reforms

President Lee Jae-myung’s administration has designated crypto market development as a “key national task” within its five-year state administration plan, prioritizing stablecoin regulations and institutional trading reforms.

The Presidential Committee on State Affairs identified “construction of a digital asset ecosystem” among 123 critical government objectives, signaling unprecedented regulatory support.

In fact, in July, the government is already moving to reclassify crypto trading firms as “venture companies,” granting access to tax incentives, subsidies, and state-backed financing previously denied since 2018.

The Ministry of SMEs and Startups proposed amendments to include Virtual Asset Service Providers under venture company status, potentially reversing policies that previously categorized crypto firms alongside gambling venues.

Financial regulators have lifted restrictions on institutional crypto investments while preparing to approve Korea’s first spot cryptocurrency ETFs.

The Financial Services Commission presented implementation measures for spot crypto ETFs and regulatory frameworks for won-based stablecoins scheduled for the second half of 2025.

Major financial institutions have filed numerous stablecoin trademark applications following Lee’s campaign promises to launch Korean won-pegged digital currencies for business and international trade.

Leading banks and IT companies are developing crypto-related business plans, anticipating opportunities in advanced payment platforms.

However, regulatory crackdowns continue in specific areas. The Financial Services Commission suspended all crypto lending services after 27,600 investors borrowed 1.5 trillion won in the first month, with 13% facing forced liquidations due to market volatility.

Young Investors Drive Adoption Despite Regulatory Uncertainties

According to a recent report from Cryptonew, Korean investors in their 20s and 30s increasingly favor crypto investments over traditional U.S. tech stocks, with crypto-related equity investments rising from 8.5% in January to 36.5% in June before declining to 31.4% in July.

The Korean Center for International Finance attributed this shift to expanding stablecoin opportunities following the U.S. GENIUS Act passage.

Retail investment in U.S. big tech shares dropped from a monthly average of $1.68 billion between January and April to just $260 million in July.

Younger demographics allocated an average of 14% of their financial assets to cryptocurrencies, with over half of South Koreans aged 20-59 having crypto trading experience.

Similarly, survey data from June indicates that 27% of respondents currently hold cryptocurrencies, with average holdings reaching 13 million won ($9,547) per investor.

Early adopters typically began with Bitcoin before diversifying into altcoins and stablecoins as experience increased, with 60% starting investments during the 2020 bull run.

While adoption is growing in the country, tax authorities have also intensified crypto asset seizures from tax evaders, with Jeju City recently completing investigations of 2,962 residents and seizing 230 million won worth of cryptocurrencies from 49 individuals.

Seoul’s Gangnam District recovered over $144,000 through similar enforcement actions, using AI-powered tools to identify hidden crypto assets.

Crypto taxation remains suspended until January 2027, creating a grace period during which capital gains taxes are not imposed.

Political leaders warn that the Democratic Party may enforce virtual asset taxation starting in 2027 to secure tax revenue amid expansionary fiscal policies.

The post Over 10,000 Koreans Now Hold $750K+ in Crypto as Young Investors Lead by Holdings appeared first on Cryptonews.